Back to Installment Sale Index - planEASe Home Page

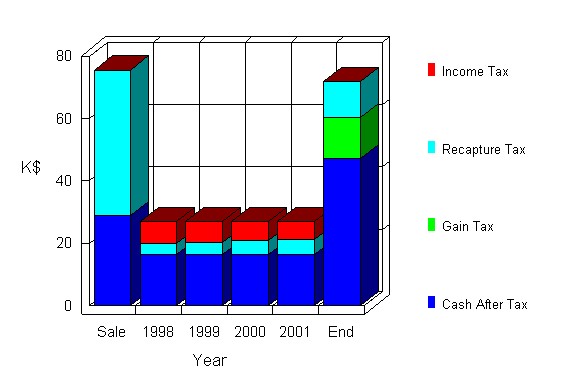

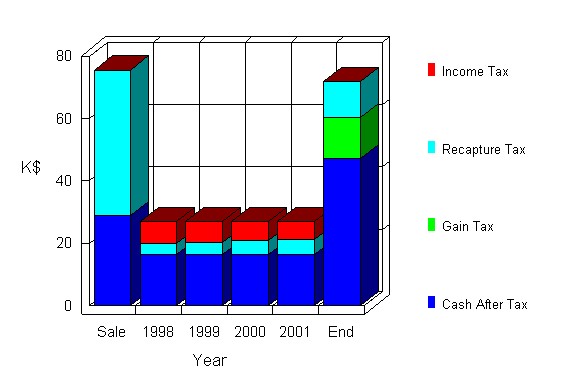

This projection shows the before and after tax cash flows associated with the Installment Sale. If you have more than one loan in your Analysis (for instance, a wrapped loan in addition to the Purchase Money loan), you can access the details of the individual loans with Detail Analysis.

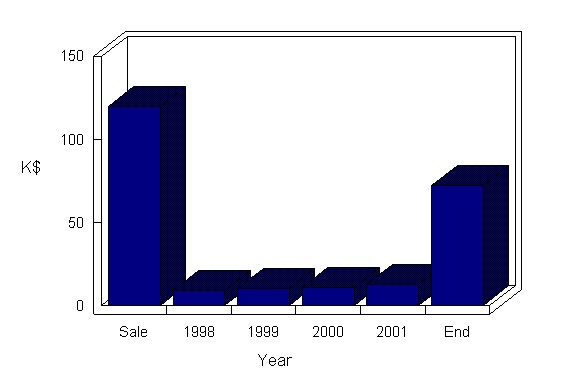

Cash Flow Before Tax shows the Sale Proceeds Before Tax detailed in the Installment Sale Report at the time of Sale. Following that, the amounts following (after the Sale) show the Debt Service cash flows for the Loan(s) and the loan repayment(s) at the End

Ordinary Income at Sale shows the Excess Cost Recovery less Expensed Sale Costs less Unamortized Loan Points less Loan Prepayment Penalties. Following the Sale, the amounts show the Interest Expense (and Amortized Points) for the Loan(s).

Income Tax is simply Ordinary Income times the Tax Rate.

Principal Received at Sale is the Down Payment received as computed in the Installment Sale Report plus any Excess Mortgage over Basis. The amounts in following years represent the principal payments on the loans in the analysis.

Recovery Recaptureis the Principal Received times the Gross Profit Ratio computed in the Installment Sale Report. until all the Cost Recovery has been recaptured. If tax is paid Pro Rata this is the Principal Received times the Recovery Ratio computed in the Installment Sale Report.

Recovery Tax is the Recovery Recapture times the Cost Recovery Recapture Rate.

Net Capital Gains is the Principal Received times the Gross Profit Ratio computed in the Installment Sale Report, once all the Cost Recovery has been recaptured. If tax is paid Pro Rata this is the Principal Received times the Profit Ratio computed in the Installment Sale Report.

Gain Tax is the Net Capital Gains times the Capital Gain Rate.

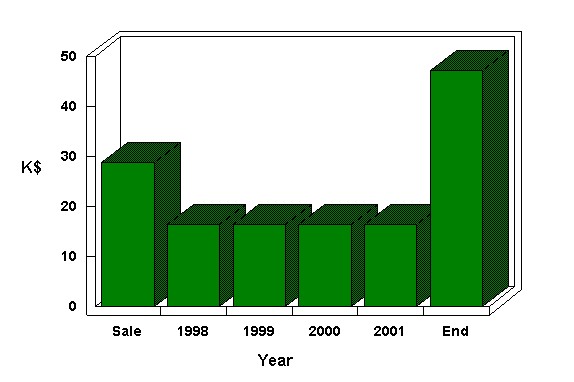

Cash Flow After Tax is the Cash Flow Before Tax less the Income Tax, Recovery Tax, and Gain Tax.

| Sale | 1998 | 1999 | 2000 | 2001 | End | Total | |

| Installment Sale Projection | |||||||

| Cash Flow Before Tax | 75,550 | 26,994 | 26,994 | 26,994 | 26,994 | 72,086 | 255,611 |

| Ordinary Income | 0 | 17,911 | 16,888 | 15,757 | 14,506 | 0 | 65,061 |

| Income Tax | 0 | 7,093 | 6,688 | 6,240 | 5,744 | 0 | 25,764 |

| Principal Received | 120,000 | 9,083 | 10,106 | 11,237 | 12,488 | 72,086 | 235,000 |

| Recovery Recapture | 186,664 | 14,129 | 15,720 | 17,480 | 19,425 | 46,582 | 300,000 |

| Recovery Tax | 46,666 | 3,532 | 3,930 | 4,370 | 4,856 | 11,646 | 75,000 |

| Net Capital Gains | 0 | 0 | 0 | 0 | 0 | 65,550 | 65,550 |

| Gain Tax | 0 | 0 | 0 | 0 | 0 | 13,110 | 13,110 |

| Cash Flow After Tax | 28,884 | 16,369 | 16,376 | 16,384 | 16,393 | 47,331 | 141,737 |

| Net Present Value Before Tax @9% | 217,920 |

| Net Present Value After Tax @9% | 117,816 |

| Accumulation of Wealth Before Tax @9% | 307,613 |

| Accumulation of Wealth After Tax @9% | 166,308 |

The data and calculations presented herein, while not guaranteed,

have been obtained from sources we believe to be reliable.

Produced by planEASe from Analytic Associates (800) 959-3273

The data and calculations presented herein, while not guaranteed,

have been obtained from sources we believe to be reliable.

Produced by planEASe from Analytic Associates (800) 959-3273

The data and calculations presented herein, while not guaranteed,

have been obtained from sources we believe to be reliable.

Produced by planEASe from Analytic Associates (800) 959-3273

The data and calculations presented herein, while not guaranteed,

have been obtained from sources we believe to be reliable.

Produced by planEASe from Analytic Associates (800) 959-3273