Back to Retail Index - planEASe Home Page

This ProForma Income Statement shows the projected results over the assumed 8 year Holding Period in one of the 1400+ different formats available (for instance, unchecking 'After Tax' eliminates all the Income Tax related lines). We could have specified an 8.75 year Holding Period, and the 2005 projection would show a full year.

| 9 Months 1997 |

1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

3 Months 2005 |

|

| Gross Income | |||||||||

| K Mart | $37,922 | $52,167 | $54,103 | $56,155 | $58,330 | $60,636 | $63,080 | $65,671 | $16,842 |

| Thrifty | 27,482 | 38,220 | 40,157 | 42,250 | 44,510 | 46,951 | 69,444 | 72,292 | 18,546 |

| Hallmark | 11,628 | 16,434 | 17,420 | 18,770 | 19,380 | 19,380 | 19,380 | 19,380 | 4,845 |

| Carl's Jr | 11,250 | 15,900 | 16,854 | 17,865 | 18,937 | 20,073 | 21,278 | 22,554 | 5,977 |

| Pizza Man | 7,875 | 11,025 | 11,686 | 12,388 | 13,131 | 13,919 | 14,754 | 15,639 | 4,026 |

| Yardages | 9,904 | 13,997 | 14,837 | 15,727 | 16,671 | 17,671 | 18,732 | 19,855 | 5,262 |

| Sushi | 8,640 | 12,211 | 12,944 | 13,721 | 14,544 | 15,416 | 16,341 | 17,322 | 4,590 |

| Minuteman | 16,740 | 23,659 | 25,079 | 26,583 | 28,178 | 29,869 | 31,661 | 33,561 | 8,894 |

| Expense Recovery | 29,597 | 40,704 | 42,427 | 44,245 | 46,163 | 48,188 | 50,327 | 52,587 | 13,290 |

| CAM Administration Fee | 1,718 | 2,393 | 2,537 | 2,689 | 2,850 | 3,021 | 3,202 | 3,395 | 861 |

| Total Gross Income | $162,754 | $226,710 | $238,044 | $250,393 | $262,695 | $275,126 | $308,200 | $322,256 | $83,133 |

| Less: Vacancy & Credit Loss | 4,883 | 6,801 | 7,141 | 7,318 | 7,299 | 7,672 | 8,665 | 9,086 | 2,349 |

| Effective Income | $157,872 | $219,909 | $230,903 | $243,075 | $255,395 | $267,453 | $299,536 | $313,170 | $80,784 |

| Less: Operating Expenses | |||||||||

| Maintenance & Repair | 8,157 | 11,365 | 12,047 | 12,770 | 13,536 | 14,349 | 15,209 | 16,122 | 4,088 |

| Utilities | 3,291 | 4,651 | 5,023 | 5,425 | 5,859 | 6,328 | 6,834 | 7,381 | 1,880 |

| Administration | 8,157 | 11,365 | 12,047 | 12,770 | 13,536 | 14,349 | 15,209 | 16,122 | 4,088 |

| Property Taxes | 15,000 | 20,300 | 20,706 | 21,120 | 21,543 | 21,973 | 22,413 | 22,861 | 5,743 |

| Security | 716 | 997 | 1,057 | 1,120 | 1,187 | 1,259 | 1,334 | 1,414 | 359 |

| Marketing | 1,431 | 1,994 | 2,113 | 2,240 | 2,375 | 2,517 | 2,668 | 2,828 | 717 |

| Insurance | 2,433 | 3,390 | 3,593 | 3,809 | 4,038 | 4,280 | 4,537 | 4,809 | 1,219 |

| Total Operating Expenses | $39,185 | $54,063 | $56,588 | $59,255 | $62,074 | $65,054 | $68,205 | $71,537 | $18,096 |

| Net Operating Income | $118,687 | $165,846 | $174,315 | $183,820 | $193,321 | $202,399 | $231,331 | $241,632 | $62,689 |

| Less: Debt Service | |||||||||

| Existing First | 52,831 | 70,441 | 70,441 | 70,441 | 70,441 | 70,441 | 70,441 | 70,441 | 17,610 |

| Seller's Second | 0 | 0 | 54,000 | 72,000 | 72,000 | 90,000 | 96,000 | 96,000 | 24,000 |

| Total Debt Service | $52,831 | $70,442 | $124,441 | $142,441 | $142,441 | $160,441 | $166,441 | $166,441 | $41,610 |

| Net Operating Cash Flow | $65,856 | $95,404 | $49,873 | $41,378 | $50,880 | $41,958 | $64,889 | $75,191 | $21,078 |

| Less: Capital Spending | |||||||||

| Tenant Improvements | 0 | 0 | 0 | 10,498 | 0 | 0 | 38,025 | 0 | 0 |

| Total Capital Spending | $0 | $0 | $0 | $10,498 | $0 | $0 | $38,025 | $0 | $0 |

| Cash Flow Before Tax | $65,856 | $95,404 | $49,873 | $30,880 | $50,880 | $41,958 | $26,864 | $75,191 | $21,078 |

| Taxable Income and Taxes | |||||||||

| (Losses Carried Forward) | |||||||||

| Taxable Revenues | $162,754 | $226,710 | $238,044 | $250,393 | $262,695 | $275,126 | $308,200 | $322,256 | $83,133 |

| Less: Deducted Expenses | 39,185 | 54,063 | 56,588 | 59,255 | 62,074 | 65,054 | 68,205 | 71,537 | 18,096 |

| Less: Interest Expense | 40,663 | 53,043 | 105,599 | 122,035 | 120,341 | 136,507 | 140,521 | 138,369 | 34,236 |

| Less: Depreciation | 30,876 | 43,590 | 43,590 | 43,668 | 43,859 | 43,859 | 44,793 | 44,834 | 13,077 |

| Ordinary Income | $52,031 | $76,014 | $32,267 | $25,434 | $36,420 | $29,705 | $54,681 | $67,515 | $17,725 |

| Taxable Income | 47,148 | 69,213 | 25,126 | 18,116 | 29,121 | 22,033 | 46,017 | 58,429 | 15,377 |

| (Cum Suspended Losses) | (4,883) | (11,684) | (18,825) | (26,143) | (33,443) | (41,115) | (49,780) | (58,866) | (61,215) |

| Taxes Due (- = Savings) | 18,671 | 27,408 | 9,950 | 7,174 | 11,532 | 8,725 | 18,223 | 23,138 | 6,089 |

| Cash Flow After Tax | $47,186 | $67,996 | $39,924 | $23,706 | $39,348 | $33,233 | $8,642 | $52,053 | $14,989 |

| Sale Proceeds: | |||||||||

| Sale Value | $0 | $1,676,236 | $1,762,181 | $1,868,361 | $1,955,024 | $2,047,344 | $2,338,311 | $2,443,100 | $2,520,819 |

| Less: Sale Costs (7%) | 0 | 117,337 | 123,353 | 130,785 | 136,852 | 143,314 | 163,682 | 171,017 | 176,457 |

| Less: Loan Repayment | 0 | 1,605,806 | 1,646,225 | 1,678,016 | 1,714,733 | 1,738,338 | 1,759,358 | 1,784,179 | 1,791,044 |

| Sale Proceeds Before Tax | 0 | (46,906) | (7,397) | 59,560 | 103,440 | 165,692 | 415,272 | 487,904 | 553,317 |

| Less: Taxes due to Sale | 0 | (138,003) | (136,767) | (131,069) | (129,456) | (116,281) | (71,067) | (61,090) | (48,537) |

| Sale Proceeds After Tax | 0 | 91,097 | 129,370 | 190,629 | 232,896 | 281,973 | 486,338 | 548,994 | 601,855 |

| Ratio Analysis: | |||||||||

| Profitability Ratios | |||||||||

| Capitalization Rate | 7.91% | 8.29% | 8.72% | 9.19% | 9.67% | 10.12% | 11.57% | 12.08% | 12.54% |

| Cash on Cash Before Tax | 16.35% | 17.77% | 9.29% | 7.71% | 9.48% | 7.81% | 12.09% | 14.00% | 15.70% |

| Cash on Cash After Tax | 11.72% | 12.66% | 7.44% | 6.37% | 7.33% | 6.19% | 8.69% | 9.69% | 11.17% |

| Accounting RoR Before Tax | 30.89% | 17.77% | 21.56% | 18.78% | 20.61% | 62.36% | 28.90% | 68.49% | |

| Accounting RoR After Tax | 25.78% | 15.91% | 20.22% | 16.63% | 18.99% | 58.97% | 24.59% | 63.95% | |

| Current RoR Before Tax | 159.10% | 100.74% | 189.79% | 35.60% | 70.91% | ||||

| Current RoR After Tax | 85.84% | 73.79% | 42.81% | 35.34% | 89.03% | 23.59% | 49.44% | ||

| Risk Ratios | |||||||||

| Debt Coverage Ratio | 2.247 | 2.354 | 1.401 | 1.290 | 1.357 | 1.262 | 1.390 | 1.452 | 1.507 |

| Breakeven Occupancy | 56.5% | 54.9% | 76.0% | 80.6% | 77.9% | 82.0% | 76.1% | 73.8% | 71.8% |

| Loan Balance/Property Value | 95.8% | 93.4% | 89.8% | 87.7% | 84.9% | 75.2% | 73.0% | 71.1% | |

| Assumption Ratios | |||||||||

| NOI/Property Value | 9.89% | 9.89% | 9.84% | 9.89% | 9.89% | 9.89% | 9.89% | 9.95% | |

| Gross Income Multiple | 7.39 | 7.40 | 7.46 | 7.44 | 7.44 | 7.59 | 7.58 | 7.58 | |

| Operating Expense Ratio | 24.1% | 23.8% | 23.8% | 23.7% | 23.6% | 23.6% | 22.1% | 22.2% | 21.8% |

| Analysis Measures: | |||||||||

| IRR Before Debt | 1.6% | 5.1% | 7.1% | 8.3% | 10.2% | 10.7% | 11.0% | ||

| IRR Before Tax | 8.4% | 10.8% | 12.1% | ||||||

| IRR After Tax | 6.6% | 8.4% | 9.4% | ||||||

| NPV Before Debt @15.00% | ($547,445) | ($524,958) | ($501,991) | ($487,949) | ($474,437) | ($399,577) | ($389,292) | ($371,220) | |

| NPV Before Tax @15.00% | ($431,058) | ($362,949) | ($303,041) | ($256,957) | ($215,889) | ($117,187) | ($86,389) | ($63,665) | |

| NPV After Tax @15.00% | ($364,333) | ($318,347) | ($278,465) | ($249,625) | ($227,285) | ($160,693) | ($145,093) | ($128,940) |

The Common Size Income Statement shows all items as a percentage of Gross Income, which is always 100%. The statement is useful for checking expense items for reasonableness against industry averages. It also can highlight input errors. For instance, we forgot to allow 3% for vacancy / credit loss when entering the Hallmark Renewal in 2000, and this report makes that clear.

| 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | |

| Gross Income | |||||||||

| K Mart | 23.3% | 23.0% | 22.7% | 22.4% | 22.2% | 22.0% | 20.5% | 20.4% | 20.3% |

| Thrifty | 16.9% | 16.9% | 16.9% | 16.9% | 16.9% | 17.1% | 22.5% | 22.4% | 22.3% |

| Hallmark | 7.1% | 7.2% | 7.3% | 7.5% | 7.4% | 7.0% | 6.3% | 6.0% | 5.8% |

| Carl's Jr | 6.9% | 7.0% | 7.1% | 7.1% | 7.2% | 7.3% | 6.9% | 7.0% | 7.2% |

| Pizza Man | 4.8% | 4.9% | 4.9% | 4.9% | 5.0% | 5.1% | 4.8% | 4.9% | 4.8% |

| Yardages | 6.1% | 6.2% | 6.2% | 6.3% | 6.3% | 6.4% | 6.1% | 6.2% | 6.3% |

| Sushi | 5.3% | 5.4% | 5.4% | 5.5% | 5.5% | 5.6% | 5.3% | 5.4% | 5.5% |

| Minuteman | 10.3% | 10.4% | 10.5% | 10.6% | 10.7% | 10.9% | 10.3% | 10.4% | 10.7% |

| Expense Recovery | 18.2% | 18.0% | 17.8% | 17.7% | 17.6% | 17.5% | 16.3% | 16.3% | 16.0% |

| CAM Administration Fee | 1.1% | 1.1% | 1.1% | 1.1% | 1.1% | 1.1% | 1.0% | 1.1% | 1.0% |

| Total Gross Income | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Less: Vacancy & Credit Loss | 3.0% | 3.0% | 3.0% | 2.9% | 2.8% | 2.8% | 2.8% | 2.8% | 2.8% |

| Effective Income | 97.0% | 97.0% | 97.0% | 97.1% | 97.2% | 97.2% | 97.2% | 97.2% | 97.2% |

| Less: Operating Expenses | |||||||||

| Maintenance & Repair | 5.0% | 5.0% | 5.1% | 5.1% | 5.2% | 5.2% | 4.9% | 5.0% | 4.9% |

| Utilities | 2.0% | 2.1% | 2.1% | 2.2% | 2.2% | 2.3% | 2.2% | 2.3% | 2.3% |

| Administration | 5.0% | 5.0% | 5.1% | 5.1% | 5.2% | 5.2% | 4.9% | 5.0% | 4.9% |

| Property Taxes | 9.2% | 9.0% | 8.7% | 8.4% | 8.2% | 8.0% | 7.3% | 7.1% | 6.9% |

| Security | 0.4% | 0.4% | 0.4% | 0.4% | 0.5% | 0.5% | 0.4% | 0.4% | 0.4% |

| Marketing | 0.9% | 0.9% | 0.9% | 0.9% | 0.9% | 0.9% | 0.9% | 0.9% | 0.9% |

| Insurance | 1.5% | 1.5% | 1.5% | 1.5% | 1.5% | 1.6% | 1.5% | 1.5% | 1.5% |

| Total Operating Expenses | 24.1% | 23.8% | 23.8% | 23.7% | 23.6% | 23.6% | 22.1% | 22.2% | 21.8% |

| Net Operating Income | 72.9% | 73.2% | 73.2% | 73.4% | 73.6% | 73.6% | 75.1% | 75.0% | 75.4% |

| Less: Debt Service | |||||||||

| Existing First | 32.5% | 31.1% | 29.6% | 28.1% | 26.8% | 25.6% | 22.9% | 21.9% | 21.2% |

| Seller's Second | 0.0% | 0.0% | 22.7% | 28.8% | 27.4% | 32.7% | 31.1% | 29.8% | 28.9% |

| Total Debt Service | 32.5% | 31.1% | 52.3% | 56.9% | 54.2% | 58.3% | 54.0% | 51.6% | 50.1% |

| Net Operating Cash Flow | 40.5% | 42.1% | 21.0% | 16.5% | 19.4% | 15.3% | 21.1% | 23.3% | 25.4% |

| Less: Capital Spending | |||||||||

| Tenant Improvements | 0.0% | 0.0% | 0.0% | 4.2% | 0.0% | 0.0% | 12.3% | 0.0% | 0.0% |

| Total Capital Spending | 0.0% | 0.0% | 0.0% | 4.2% | 0.0% | 0.0% | 12.3% | 0.0% | 0.0% |

| Cash Flow Before Tax | 40.5% | 42.1% | 21.0% | 12.3% | 19.4% | 15.3% | 8.7% | 23.3% | 25.4% |

The Square Footage Income Statement shows all items on a $ / sf basis. This statement is also useful for checking expense items for reasonableness against industry averages, as well comparing the tenant leases on an apples / apples basis.

| 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | |

| Gross Income | |||||||||

| K Mart (5,700 sf) | $8.87 | $9.15 | $9.49 | $9.85 | $10.23 | $10.64 | $11.07 | $11.52 | $11.82 |

| Thrifty (4,225 sf) | 8.67 | 9.05 | 9.50 | 10.00 | 10.53 | 11.11 | 16.44 | 17.11 | 17.56 |

| Hallmark (1,615 sf) | 9.60 | 10.18 | 10.79 | 11.62 | 12.00 | 12.00 | 12.00 | 12.00 | 12.00 |

| Carl's Jr (1,500 sf) | 10.00 | 10.60 | 11.24 | 11.91 | 12.62 | 13.38 | 14.19 | 15.04 | 15.94 |

| Pizza Man (1,050 sf) | 10.00 | 10.50 | 11.13 | 11.80 | 12.51 | 13.26 | 14.05 | 14.89 | 15.34 |

| Yardages (1,390 sf) | 9.50 | 10.07 | 10.67 | 11.31 | 11.99 | 12.71 | 13.48 | 14.28 | 15.14 |

| Sushi (1,200 sf) | 9.60 | 10.18 | 10.79 | 11.43 | 12.12 | 12.85 | 13.62 | 14.43 | 15.30 |

| Minuteman (2,400 sf) | 9.30 | 9.86 | 10.45 | 11.08 | 11.74 | 12.45 | 13.19 | 13.98 | 14.82 |

| Expense Recovery | 2.07 | 2.13 | 2.22 | 2.32 | 2.42 | 2.53 | 2.64 | 2.76 | 2.79 |

| CAM Administration Fee | 0.12 | 0.13 | 0.13 | 0.14 | 0.15 | 0.16 | 0.17 | 0.18 | 0.18 |

| Total Gross Income | $11.37 | $11.88 | $12.48 | $13.12 | $13.77 | $14.42 | $16.15 | $16.89 | $17.43 |

| Less: Vacancy & Credit Loss | 0.34 | 0.36 | 0.37 | 0.38 | 0.38 | 0.40 | 0.45 | 0.48 | 0.49 |

| Effective Income | $11.03 | $11.53 | $12.10 | $12.74 | $13.39 | $14.02 | $15.70 | $16.41 | $16.94 |

| Less: Operating Expenses | |||||||||

| Maintenance & Repair | 0.57 | 0.60 | 0.63 | 0.67 | 0.71 | 0.75 | 0.80 | 0.84 | 0.86 |

| Utilities | 0.23 | 0.24 | 0.26 | 0.28 | 0.31 | 0.33 | 0.36 | 0.39 | 0.39 |

| Administration | 0.57 | 0.60 | 0.63 | 0.67 | 0.71 | 0.75 | 0.80 | 0.84 | 0.86 |

| Property Taxes | 1.05 | 1.06 | 1.09 | 1.11 | 1.13 | 1.15 | 1.17 | 1.20 | 1.20 |

| Security | 0.05 | 0.05 | 0.06 | 0.06 | 0.06 | 0.07 | 0.07 | 0.07 | 0.08 |

| Marketing | 0.10 | 0.10 | 0.11 | 0.12 | 0.12 | 0.13 | 0.14 | 0.15 | 0.15 |

| Insurance | 0.17 | 0.18 | 0.19 | 0.20 | 0.21 | 0.22 | 0.24 | 0.25 | 0.26 |

| Total Operating Expenses | $2.74 | $2.83 | $2.97 | $3.11 | $3.25 | $3.41 | $3.57 | $3.75 | $3.79 |

| Net Operating Income | $8.29 | $8.69 | $9.14 | $9.63 | $10.13 | $10.61 | $12.12 | $12.66 | $13.14 |

| Less: Debt Service | |||||||||

| Existing First | 3.69 | 3.69 | 3.69 | 3.69 | 3.69 | 3.69 | 3.69 | 3.69 | 3.69 |

| Seller's Second | 0.00 | 0.00 | 2.83 | 3.77 | 3.77 | 4.72 | 5.03 | 5.03 | 5.03 |

| Total Debt Service | $3.69 | $3.69 | $6.52 | $7.47 | $7.47 | $8.41 | $8.72 | $8.72 | $8.72 |

| Net Operating Cash Flow | $4.60 | $5.00 | $2.61 | $2.17 | $2.67 | $2.20 | $3.40 | $3.94 | $4.42 |

| Less: Capital Spending | |||||||||

| Tenant Improvements | 0.00 | 0.00 | 0.00 | 0.55 | 0.00 | 0.00 | 1.99 | 0.00 | 0.00 |

| Total Capital Spending | $0.00 | $0.00 | $0.00 | $0.55 | $0.00 | $0.00 | $1.99 | $0.00 | $0.00 |

| Cash Flow Before Tax | $4.60 | $5.00 | $2.61 | $1.62 | $2.67 | $2.20 | $1.41 | $3.94 | $4.42 |

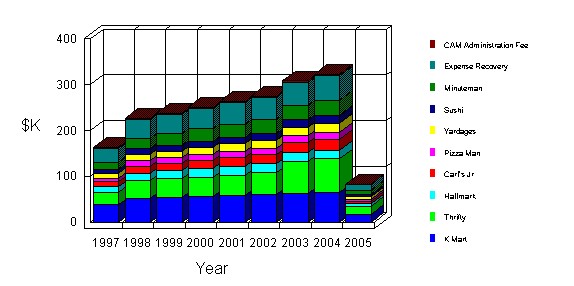

There are more than 200 graphs and pie charts available in planEASe. Here's a bar stack graph of the projected revenues in the previous ProForma Income Statement. You can choose to graph any line in that statement. It's as easy as clicking on the desired line on the screen and pressing the Graph button. Here we choose to print the graph in landscape orientation to match the previous Income Statements.

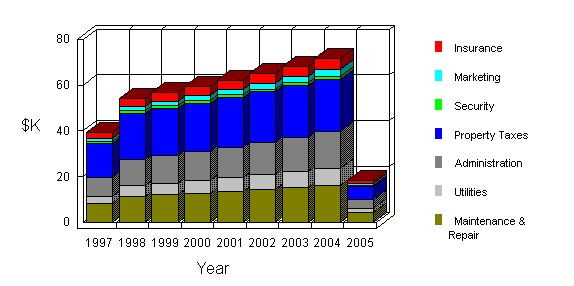

Here is a graph of the expense breakdown from the same Income Statements. There are many options for displaying and printing the graphs. Here we've chosen to fill the bar stack with patterns rather than gray scales, which some may find easier to read when printing with a monochrome printer.