The first thing you must evaluate is the amount of money he would realize from selling his building currently (Investment Base). Your client, Jack, owns his 20,000 square foot industrial building in which he imports foreign-made computers to resell to business and industry. He built the building 10 years ago (in 1991) for a total cost of $450,000 on land that he acquired for $50,000. He has taken straight-line depreciation over a 31.5 year life and he financed the property with a $400,000 mortgage over 20 years at 9% fixed interest.

| Investment Assumptions | ||

| Price of Property | $500,000.00 | |

| Date of Acquisition | 1 January 1991 | |

| Holding Period | 10 Years | |

| Inflation Rate | Zero | |

| Sale Price Method | Sale Price = $800,000.00 | |

| Selling Costs | 10% | |

| Investor's Assumptions | ||

| General Vacancy & Credit Loss | Zero | |

| Tax Rate - First Year | 35% | |

| Tax Rate - Following Years | 35% | |

| Capital Gain Rate | 35% | |

| Cost Recovery Recapture Rate | 35% - Losses Taken Currently | |

| Present Value Discount Rate Before Debt | 12% per Year | |

| Present Value Discount Rate Before Tax | 12% per Year | |

| Present Value Discount Rate After Tax | 12% per Year | |

| Depreciation Assumptions | ||

| Depreciable Amount | $450,000.00 | |

| Depreciable Life | 31.5 Years | |

| Depreciation Method | Straight Line | |

| Depreciation Start Date | at Acquisition | |

| Loan Assumptions | ||

| Loan Amount | $400,000.00 | |

| Loan Interest Rate | 9% Annually | |

| Original Loan Period | 20 Years | |

| Loan Origination Date | at Acquisition | |

| Loan Type | Monthly Payments, Amortizing | |

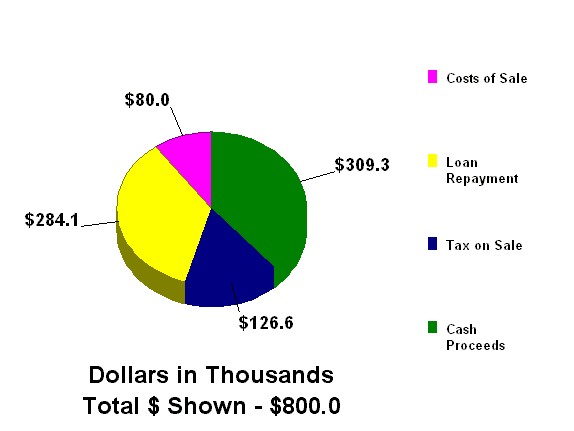

This report shows that Jack would net $309,314 (Investment Base) from the sale of the building after paying transaction costs, repaying the loan balance, and paying Capital Gain Tax.

| Analysis of Sale Proceeds | |||

| Sale Price (as discussed above) | $800,000 | ||

| - Costs of Sale (10%) | 80,000 | ||

| - Loan Balances | 284,102 | ||

| - Prepayment Penalties | 0 | ||

| Sale Proceeds Before Tax | $435,898 | ||

| Analysis of Capital Gain Results | |||

| Sale Price | $800,000 | ||

| - Capitalized Costs of Sale (100%) | 80,000 | ||

| Net Sale Price for Tax Purposes | $720,000 | ||

| Property Basis at Acquisition | $500,000 | ||

| + Capitalized Closing Costs (100%) | 0 | ||

| + Capital Additions | 0 | ||

| - Depreciation Taken | 141,667 | ||

| + Excess Depreciation Recaptured | 0 | ||

| Adjusted Basis at Sale | 358,333 | ||

| Capital Gain (or Loss) | $361,667 | ||

| - Suspended Passive Losses | 0 | ||

| Net Capital Gain (or Loss) | $361,667 | ||

| - Cost Recovery Recaptured | 141,667 | ||

| Adjusted Net Capital Gain (or Loss) | $220,000 | ||

| Cost Recovery Recapture Tax (@ 35%) | (49,583) | ||

| Tax on Adjusted Net Capital Gain (@ 35%) | (77,000) | ||

| Expenses Recognized at Sale | |||

| Expensed Costs of Sale | 0 | ||

| + Accrued Loan Interest | 0 | ||

| + Unamortized Points | 0 | ||

| + Prepayment Penalties | 0 | ||

| - Excess Depreciation Recaptured | 0 | ||

| Total Expenses Recognized at Sale | 0 | ||

| Tax Savings Due to Sale Expenses (@ 35%) | 0 | ||

| Net Taxable Income | $361,667 | ||

| After Tax Cash Proceeds of Sale | $309,314 |

Now, you set up the assumptions associated with Jack continuing to hold the building and foregoing the investment (Stay and not Sell).

| Investment Assumptions | ||

| Price of Property | $593,416.00 | |

| Date of Acquisition | 1 January 2001 | |

| Holding Period | 10 Years | |

| Inflation Rate | Zero | |

| Sale Price Method | Sale Price = $1,058,000.00 | |

| Selling Costs | 10% | |

| Investor's Assumptions | ||

| General Vacancy & Credit Loss | Zero | |

| Tax Rate - First Year | 35% | |

| Tax Rate - Following Years | 35% | |

| Capital Gain Rate | 35% | |

| Cost Recovery Recapture Rate | 35% - Losses Taken Currently | |

| Present Value Discount Rate Before Debt | 12% per Year | |

| Present Value Discount Rate Before Tax | 12% per Year | |

| Present Value Discount Rate After Tax | 12% per Year | |

| Building Depreciation Assumptions | ||

| Depreciable Amount | $450,000.00 | |

| Depreciable Life | 31.5 Years | |

| Depreciation Method | Straight Line w/o First Half Period Rule | |

| Recapture Method | Excess Over Straight Line | |

| Depreciation Start Date | at Acquisition | |

| Set Substitute Basis Assumptions | ||

|

||

| Substitute Basis | $357,738.00 | |

| Prior Cost Recovery Taken | $142,262.00 | |

| Loan Assumptions | ||

| Loan Amount | $400,000.00 | |

| Loan Interest Rate | 9% Annually | |

| Original Loan Period | 20 Years | |

| Loan Origination Date | 1 January 1991 | |

| Loan Type | Monthly Payments, Amortizing | |

| Lease Payment Revenue Assumptions | ||

| Annual Revenue | $80,000.00 | |

| Revenue Start Date | at Acquisition | |

| Revenue Period | 5 Years | |

| Revenue Growth Method | No Growth is Projected | |

| Lease Payment Second 5 Years Revenue Assumptions | ||

| Annual Revenue | $92,000.00 | |

| Revenue Start Date | Continuation | |

| Revenue Period | 5 Years | |

| Revenue Growth Method | No Growth is Projected | |

Now, you set up the assumptions associated with Jack continuing to hold the building and foregoing the investment (Stay and not Sell).

| Investment Assumptions | ||

| Price of Property | $593,416.00 | |

| Date of Acquisition | 1 January 2001 | |

| Holding Period | 10 Years | |

| Inflation Rate | Zero | |

| Sale Price Method | Sale Price = $1,058,000.00 | |

| Selling Costs | 10% | |

| Investor's Assumptions | ||

| General Vacancy & Credit Loss | Zero | |

| Tax Rate - First Year | 35% | |

| Tax Rate - Following Years | 35% | |

| Capital Gain Rate | 35% | |

| Cost Recovery Recapture Rate | 35% - Losses Taken Currently | |

| Present Value Discount Rate Before Debt | 12% per Year | |

| Present Value Discount Rate Before Tax | 12% per Year | |

| Present Value Discount Rate After Tax | 12% per Year | |

| Building Depreciation Assumptions | ||

| Depreciable Amount | $450,000.00 | |

| Depreciable Life | 31.5 Years | |

| Depreciation Method | Straight Line w/o First Half Period Rule | |

| Recapture Method | Excess Over Straight Line | |

| Depreciation Start Date | at Acquisition | |

| Set Substitute Basis Assumptions | ||

|

||

| Substitute Basis | $357,738.00 | |

| Prior Cost Recovery Taken | $142,262.00 | |

| Loan Assumptions | ||

| Loan Amount | $400,000.00 | |

| Loan Interest Rate | 9% Annually | |

| Original Loan Period | 20 Years | |

| Loan Origination Date | 1 January 1991 | |

| Loan Type | Monthly Payments, Amortizing | |

| Buy | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | Sell | Total | |

| Before Tax Cash Flow Projection | |||||||||||||

| Investment and Sale | (593,416) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 952,200 | 358,784 |

| Effective Income | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Operating Expense | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Cash Flow Before Debt | (593,416) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 952,200 | 358,784 |

| Debt Service | 284,102 | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,183) | 0 | (147,763) |

| Cash Flow Before Tax | (309,314) | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,183) | 952,200 | 211,021 |

| Taxable Income Projection | |||||||||||||

| Taxable Revenue | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Taxable Expense | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Interest Expense | 0 | (24,824) | (23,101) | (21,217) | (19,156) | (16,902) | (14,436) | (11,739) | (8,789) | (5,563) | (2,033) | 0 | (147,763) |

| Depreciation | 0 | (14,286) | (14,286) | (14,286) | (14,286) | (14,286) | (14,286) | (14,286) | (14,286) | (14,286) | (13,690) | 0 | (142,262) |

| Ordinary Income | 0 | (39,110) | (37,387) | (35,503) | (33,442) | (31,188) | (28,722) | (26,025) | (23,075) | (19,848) | (15,724) | 0 | (290,025) |

| After Tax Cash Flow Projection | |||||||||||||

| Cash Flow Before Tax | (309,314) | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,187) | (43,183) | 952,200 | 211,021 |

| Ordinary Income | 0 | (39,110) | (37,387) | (35,503) | (33,442) | (31,188) | (28,722) | (26,025) | (23,075) | (19,848) | (15,724) | 0 | (290,025) |

| Capital Gains | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 736,724 | 736,724 |

| Taxable Income | 0 | (39,110) | (37,387) | (35,503) | (33,442) | (31,188) | (28,722) | (26,025) | (23,075) | (19,848) | (15,724) | 736,724 | 446,699 |

| Taxes | 0 | 13,688 | 13,086 | 12,426 | 11,705 | 10,916 | 10,053 | 9,109 | 8,076 | 6,947 | 5,503 | (257,853) | (156,345) |

| Cash Flow After Tax | (309,314) | (29,499) | (30,101) | (30,761) | (31,482) | (32,271) | (33,134) | (34,078) | (35,111) | (36,240) | (37,679) | 694,347 | 54,677 |

| Rate of Return Before Debt (IRR) | 4.9% |

| Rate of Return Before Tax (IRR) | 3.5% |

| Rate of Return After Tax (IRR) | 1.1% |

| Net Present Value Before Debt @12% | (286,833) |

| Net Present Value Before Tax @12% | (261,109) |

| Net Present Value After Tax @12% | (278,559) |

| Investment Assumptions | ||

| Price of Property | None | |

| Date of Acquisition | 1 January 2001 | |

| Holding Period | 10 Years | |

| Inflation Rate | Zero | |

| Sale Price Method | No Sale Price Specified | |

| Investor's Assumptions | ||

| General Vacancy & Credit Loss | Zero | |

| Tax Rate - First Year | 35% | |

| Tax Rate - Following Years | 35% | |

| Capital Gain Rate | 35% | |

| Cost Recovery Recapture Rate | 35% - Losses Taken Currently | |

| Present Value Discount Rate Before Debt | 12% per Year | |

| Present Value Discount Rate Before Tax | 12% per Year | |

| Present Value Discount Rate After Tax | 12% per Year | |

| Lease Payment Revenue Assumptions | ||

| Annual Revenue | ($80,000.00) | |

| Revenue Start Date | at Acquisition | |

| Revenue Period | 5 Years | |

| Revenue Growth Method | No Growth is Projected | |

| Lease Payment Second 5 Years Revenue Assumptions | ||

| Annual Revenue | ($92,000.00) | |

| Revenue Start Date | Continuation | |

| Revenue Period | 5 Years | |

| Revenue Growth Method | No Growth is Projected | |

| Buy | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | Sell | Total | |

| Before Tax Cash Flow Projection | |||||||||||||

| Investment and Sale | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Effective Income | 0 | (80,000) | (80,000) | (80,000) | (80,000) | (80,000) | (92,000) | (92,000) | (92,000) | (92,000) | (92,000) | 0 | (860,000) |

| Operating Expense | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Cash Flow Before Debt | 0 | (80,000) | (80,000) | (80,000) | (80,000) | (80,000) | (92,000) | (92,000) | (92,000) | (92,000) | (92,000) | 0 | (860,000) |

| Debt Service | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Cash Flow Before Tax | 0 | (80,000) | (80,000) | (80,000) | (80,000) | (80,000) | (92,000) | (92,000) | (92,000) | (92,000) | (92,000) | 0 | (860,000) |

| Taxable Income Projection | |||||||||||||

| Taxable Revenue | 0 | (80,000) | (80,000) | (80,000) | (80,000) | (80,000) | (92,000) | (92,000) | (92,000) | (92,000) | (92,000) | 0 | (860,000) |

| Taxable Expense | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Interest Expense | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Depreciation | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Ordinary Income | 0 | (80,000) | (80,000) | (80,000) | (80,000) | (80,000) | (92,000) | (92,000) | (92,000) | (92,000) | (92,000) | 0 | (860,000) |

| After Tax Cash Flow Projection | |||||||||||||

| Cash Flow Before Tax | 0 | (80,000) | (80,000) | (80,000) | (80,000) | (80,000) | (92,000) | (92,000) | (92,000) | (92,000) | (92,000) | 0 | (860,000) |

| Ordinary Income | 0 | (80,000) | (80,000) | (80,000) | (80,000) | (80,000) | (92,000) | (92,000) | (92,000) | (92,000) | (92,000) | 0 | (860,000) |

| Capital Gains | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Taxable Income | 0 | (80,000) | (80,000) | (80,000) | (80,000) | (80,000) | (92,000) | (92,000) | (92,000) | (92,000) | (92,000) | 0 | (860,000) |

| Taxes | 0 | 28,000 | 28,000 | 28,000 | 28,000 | 28,000 | 32,200 | 32,200 | 32,200 | 32,200 | 32,200 | 0 | 301,000 |

| Cash Flow After Tax | 0 | (52,000) | (52,000) | (52,000) | (52,000) | (52,000) | (59,800) | (59,800) | (59,800) | (59,800) | (59,800) | 0 | (559,000) |

| Rate of Return Before Debt (IRR) | 0.0% |

| Rate of Return Before Tax (IRR) | 0.0% |

| Rate of Return After Tax (IRR) | 0.0% |

| Net Present Value Before Debt @12% | (504,615) |

| Net Present Value Before Tax @12% | (504,615) |

| Net Present Value After Tax @12% | (328,000) |

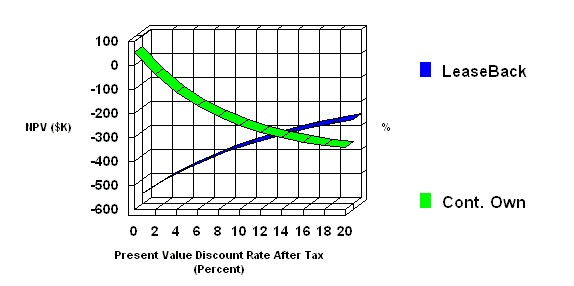

Present Value Discount Rate After Tax

versus

Net Present Value After Tax @12%

| Assumption Value |

LeaseBack NPV |

Cont. Own NPV |

| Zero | (559,000) | 54,677 |

| 2% per Year | (505,381) | (38,082) |

| 4% per Year | (459,254) | (111,123) |

| 6% per Year | (419,376) | (168,733) |

| 8% per Year | (384,734) | (214,224) |

| 10% per Year | (354,502) | (250,165) |

| 12% per Year | (328,000) | (278,559) |

| 14% per Year | (304,669) | (300,971) |

| 16% per Year | (284,043) | (318,631) |

| 18% per Year | (265,738) | (332,507) |

| 20% per Year | (249,428) | (343,365) |

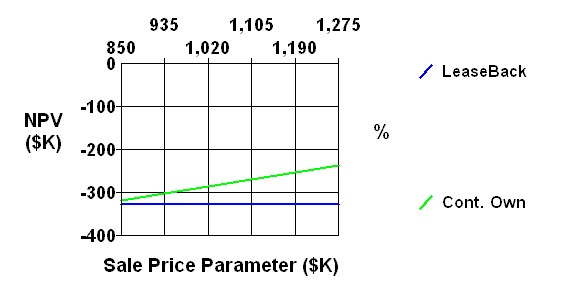

Sale Price Parameter

versus

Net Present Value After Tax @12%

| Assumption Value |

LeaseBack NPV |

Cont. Own NPV |

| No Sale Price Computed | (328,000) | (317,737) |

| No Sale Price Computed | (328,000) | (301,727) |

| No Sale Price Computed | (328,000) | (285,716) |

| No Sale Price Computed | (328,000) | (269,706) |

| No Sale Price Computed | (328,000) | (253,696) |

| No Sale Price Computed | (328,000) | (237,686) |