Lease/Buy Analysis

This is a simple Lease vs.

Buy case. For this analysis to work the one client is deciding to lease or buy

one property only. If there are more choices, or the possibility of more

choices, use the cost comparison process. In this case the client is going to

use this property for business. The choice is whether to lease or buy the space.

Buying the property requires a down payment and loan payments. Leasing does not

require a down payment, but the amount of the lease payments are greater than

the loan service costs. Should the client use the down payment to buy the

property or should the client use that down payment amount in some other

investment? It is a better

decision to lease and invest the down payment in another investment when the

other investment returns more money than would be saved by buying the property.

If the other investment does not return more money than would be saved, then it

is better to buy the property. Sounds simple! Remember that the assumptions

that lead to any conclusion can change. The advantage that planEASe delivers is

not only ease of use, but the ability to vary the assumptions to make the most

informed decision possible. In this particular sample, the lease calls for all

expenses to be paid for by the tenant. This means the expenses are the same in

either case. This means they are a wash, and need not be included in the

analysis.

Analysis Assumptions Report

Lease/Buy Analysis

produces a report showing (in English) the assumptions used to generate the other reports. It was created with the idea of generating an assumptions report which can be presented to an investor or other concerned party to explain the assumptive basis of the other planEASe reports.

|

Investment Assumptions |

||

|

Price of Property |

|

$1,000,000.00 |

|

Closing Costs |

|

2% of Property Price |

|

Date of Acquisition |

|

1 January 2010 |

|

Holding Period |

|

10 Years |

|

Inflation Rate |

|

5% per Year |

|

Sale Price Method |

|

Continuous Growth at Inflation Rate |

|

Selling Costs |

|

6% |

|

|

|

|

|

Investor's Assumptions |

||

|

General Vacancy & Credit Loss |

|

Zero |

|

Tax Rate - First Year |

|

34% |

|

Tax Rate - Following Years |

|

34% |

|

Capital Gain Rate |

|

34% |

|

Cost Recovery Recapture Rate |

|

34% - Losses Taken Currently |

|

Present Value Discount Rate Before Debt |

|

12% per Year |

|

Present Value Discount Rate Before Tax |

|

12% per Year |

|

Present Value Discount Rate After Tax |

|

12% per Year |

|

|

|

|

|

Building Depreciation Assumptions |

||

|

Depreciable Amount |

|

75% of Property Price |

|

Depreciable Life |

|

39 Years |

|

Depreciation Method |

|

Straight Line |

|

Depreciation Start Date |

|

at Acquisition |

|

|

|

|

|

New First Loan Assumptions |

||

|

Loan Amount |

|

80% of Property Price |

|

Loan Interest Rate |

|

10.5% Annually |

|

Original Loan Period |

|

30 Years |

|

Loan Origination Date |

|

at Acquisition |

|

Loan Type |

|

Monthly Payments, Amortizing |

|

Loan Points Charged |

|

1.5 Points, Amortized over Loan Life |

|

|

|

|

|

Lease Payment Revenue Assumptions |

||

|

Annual Revenue |

|

$93,000.00 |

|

Revenue Start Date |

|

at Acquisition |

|

Revenue Period |

|

Until Projected Sale |

|

Revenue Growth Method |

|

Annual at the Inflation Rate |

|

|

|

|

|

|

|

|

Before Tax Cash Flow Projection

Lease/Buy Analysis

details the results of the analysis. Produces the return on savings by purchasing the property (the point of indifference). Both before and after tax returns are shown.

|

|

Investment |

Effective |

Operating |

Cash Flow |

Debt |

Cash Flow |

|

Buy |

(1,020,000) |

0 |

0 |

(1,020,000) |

788,000 |

(232,000) |

|

2010 |

0 |

93,000 |

0 |

93,000 |

(87,815) |

5,185 |

|

2011 |

0 |

97,650 |

0 |

97,650 |

(87,815) |

9,835 |

|

2012 |

0 |

102,533 |

0 |

102,533 |

(87,815) |

14,717 |

|

2013 |

0 |

107,659 |

0 |

107,659 |

(87,815) |

19,844 |

|

2014 |

0 |

113,042 |

0 |

113,042 |

(87,815) |

25,227 |

|

2015 |

0 |

118,694 |

0 |

118,694 |

(87,815) |

30,879 |

|

2016 |

0 |

124,629 |

0 |

124,629 |

(87,815) |

36,814 |

|

2017 |

0 |

130,860 |

0 |

130,860 |

(87,815) |

43,045 |

|

2018 |

0 |

137,403 |

0 |

137,403 |

(87,815) |

49,588 |

|

2019 |

0 |

144,274 |

0 |

144,274 |

(87,815) |

56,458 |

|

Sell |

1,531,161 |

0 |

0 |

1,531,161 |

(732,978) |

798,184 |

|

Total |

511,161 |

1,169,744 |

0 |

1,680,905 |

(823,128) |

857,777 |

|

Rate of Return Before Debt (IRR) |

14.3% |

|

Rate of Return Before Tax (IRR) |

19.6% |

|

Net Present Value Before Debt @12% |

141,970 |

|

Net Present Value Before Tax @12% |

168,590 |

|

|

|

|

Taxable Income Projection

Lease/Buy Analysis

details the results of the analysis. Produces the return on savings by purchasing the property (the point of indifference). Both before and after tax returns are shown.

|

|

Taxable |

Taxable |

Interest |

Depre- |

Ordinary |

|

Buy |

0 |

0 |

0 |

0 |

0 |

|

2010 |

93,000 |

0 |

(84,211) |

(18,429) |

(9,640) |

|

2011 |

97,650 |

0 |

(83,770) |

(19,231) |

(5,350) |

|

2012 |

102,533 |

0 |

(83,280) |

(19,231) |

22 |

|

2013 |

107,659 |

0 |

(82,736) |

(19,231) |

5,692 |

|

2014 |

113,042 |

0 |

(82,132) |

(19,231) |

11,679 |

|

2015 |

118,694 |

0 |

(81,462) |

(19,231) |

18,002 |

|

2016 |

124,629 |

0 |

(80,717) |

(19,231) |

24,681 |

|

2017 |

130,860 |

0 |

(79,891) |

(19,231) |

31,738 |

|

2018 |

137,403 |

0 |

(78,974) |

(19,231) |

39,199 |

|

2019 |

144,274 |

0 |

(77,955) |

(18,429) |

47,889 |

|

Sell |

0 |

0 |

(8,000) |

0 |

(8,000) |

|

Total |

1,169,744 |

0 |

(823,128) |

(190,705) |

155,911 |

|

|

|

|

After Tax Cash Flow Projection

Lease/Buy Analysis

details the results of the analysis. Produces the return on savings by purchasing the property (the point of indifference). Both before and after tax returns are shown.

|

|

Cash Flow |

Ordinary |

Capital |

Taxable |

|

Cash Flow |

|

Buy |

(232,000) |

0 |

0 |

0 |

0 |

(232,000) |

|

2010 |

5,185 |

(9,640) |

0 |

(9,640) |

3,278 |

8,463 |

|

2011 |

9,835 |

(5,350) |

0 |

(5,350) |

1,819 |

11,654 |

|

2012 |

14,717 |

22 |

0 |

22 |

(7) |

14,710 |

|

2013 |

19,844 |

5,692 |

0 |

5,692 |

(1,935) |

17,909 |

|

2014 |

25,227 |

11,679 |

0 |

11,679 |

(3,971) |

21,256 |

|

2015 |

30,879 |

18,002 |

0 |

18,002 |

(6,121) |

24,759 |

|

2016 |

36,814 |

24,681 |

0 |

24,681 |

(8,391) |

28,422 |

|

2017 |

43,045 |

31,738 |

0 |

31,738 |

(10,791) |

32,254 |

|

2018 |

49,588 |

39,199 |

0 |

39,199 |

(13,328) |

36,261 |

|

2019 |

56,458 |

47,889 |

0 |

47,889 |

(16,282) |

40,176 |

|

Sell |

798,184 |

(8,000) |

701,866 |

693,866 |

(235,915) |

562,269 |

|

Total |

857,777 |

155,911 |

701,866 |

857,777 |

(291,644) |

566,133 |

|

Rate of Return Before Tax (IRR) |

19.6% |

|

Rate of Return After Tax (IRR) |

15.9% |

|

Net Present Value Before Tax @12% |

168,590 |

|

Net Present Value After Tax @12% |

71,027 |

|

|

|

|

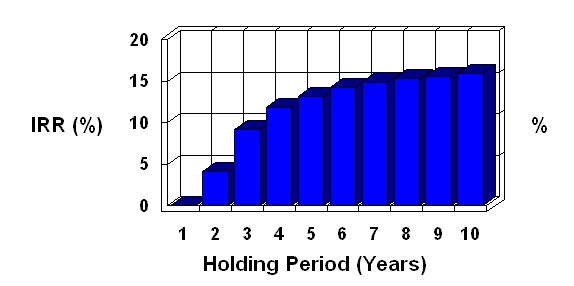

Sensitivity Analysis

Lease/Buy Analysis

As you perform an analysis, planEASe measures the worth of the investment in terms of rates of return and net present values. Sensitivity Analysis allows you to investigate how these measures vary with a change in one of the assumptions. Any measure may be chosen for the Sensitivity Analysis, and any assumption may be chosen as well. Sensitivity Analysis provides a one page table and graph which describes the relationship between the assumption value and the resulting measure.

Holding

Period

versus

Rate of Return After Tax

|

Assumption |

IRR |

|

1 Year |

0.0% |

|

2 Years |

4.1% |

|

3 Years |

9.2% |

|

4 Years |

11.8% |

|

5 Years |

13.2% |

|

6 Years |

14.2% |

|

7 Years |

14.9% |

|

8 Years |

15.3% |

|

9 Years |

15.6% |

|

10 Years |

15.9% |

|

|

|

|

Sensitivity Analysis

Lease/Buy Analysis

As you perform an analysis, planEASe measures the worth of the investment in terms of rates of return and net present values. Sensitivity Analysis allows you to investigate how these measures vary with a change in one of the assumptions. Any measure may be chosen for the Sensitivity Analysis, and any assumption may be chosen as well. Sensitivity Analysis provides a one page table and graph which describes the relationship between the assumption value and the resulting measure.

Property

Value Yearly Growth Rate (%>Inflation)

versus

Rate of Return After Tax

|

Assumption |

IRR |

|

At the Inflation Rate |

15.9% |

|

1% Over Inflation |

17.2% |

|

2% Over Inflation |

18.5% |

|

3% Over Inflation |

19.9% |

|

4% Over Inflation |

21.2% |

|

5% Over Inflation |

22.4% |

|

6% Over Inflation |

23.7% |

|

7% Over Inflation |

24.9% |

|

8% Over Inflation |

26.1% |

|

9% Over Inflation |

27.3% |

|

10% Over Inflation |

28.5% |

|

|

|

|

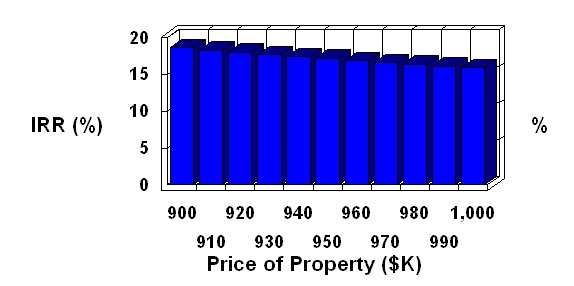

Sensitivity Analysis

Lease/Buy Analysis

As you perform an analysis, planEASe measures the worth of the investment in terms of rates of return and net present values. Sensitivity Analysis allows you to investigate how these measures vary with a change in one of the assumptions. Any measure may be chosen for the Sensitivity Analysis, and any assumption may be chosen as well. Sensitivity Analysis provides a one page table and graph which describes the relationship between the assumption value and the resulting measure.

Price

of Property

versus

Rate of Return After Tax

|

Assumption |

IRR |

|

$900,000.00 |

18.6% |

|

$910,000.00 |

18.3% |

|

$920,000.00 |

18.0% |

|

$930,000.00 |

17.7% |

|

$940,000.00 |

17.4% |

|

$950,000.00 |

17.2% |

|

$960,000.00 |

16.9% |

|

$970,000.00 |

16.6% |

|

$980,000.00 |

16.4% |

|

$990,000.00 |

16.1% |

|

$1,000,000.00 |

15.9% |

|

|

|

|